Cystic Fibrosis Therapeutics Market (By Major Marketed Products, Pharmacological Class, & Geography) And Pipeline Analysis – Global Forecast To 2024

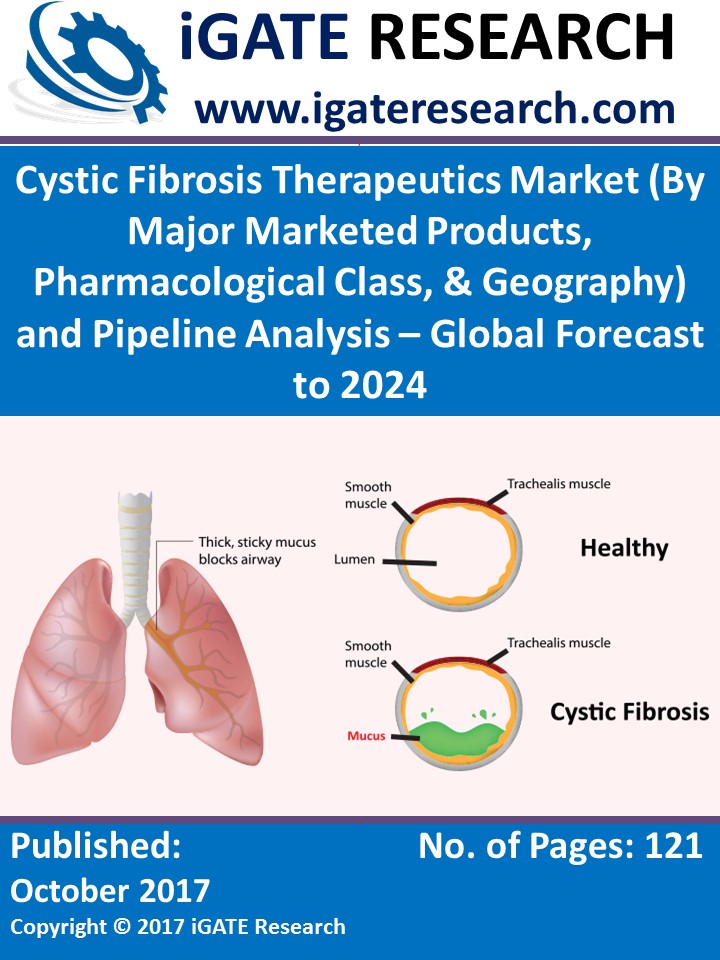

The market for Cystic Fibrosis Therapeutics is anticipated to grow with double digit CAGR during the forecasting period. Cystic fibrosis is among the most common life-threatening genetic disorders worldwide. It is caused by defects in a single gene known as the cystic fibrosis transmembrane conductance regulator, or CFTR.

The market for Cystic Fibrosis Therapeutics is anticipated to grow with double digit CAGR during the forecasting period. Cystic fibrosis is among the most common life-threatening genetic disorders worldwide. It is caused by defects in a single gene known as the cystic fibrosis transmembrane conductance regulator, or CFTR. The increasing prevalence of cystic fibrosis, rising awareness about cystic fibrosis therapy, strong pipeline candidates, technological advancement and high rate of R&D initiatives are some of the major factors that are driving cystic fibrosis therapeutics market. However, high cost involved in treatment, increase in complexity of disease are restraining the cystic fibrosis therapeutics market.

Key Highlights of the Report

• United States dominates the global market for cystic fibrosis therapeutics.

• The EU5 countries together accounted for over 20% share of the global cystic fibrosis market in 2016.

• In Asian region, the prevalence of Cystic Fibrosis is observed to be very low in countries like China, India and Japan.

• On the basis of pharmacological class, the CFTR modulator captures highest share of the total CF therapeutics market in 2016.

• In 2016, mucolyctics agents accounted for around xx% of the global cystic fibrosis therapeutics market.

• Cystic Fibrosis patients who have reduced the levels of digestive enzymes due to improper functioning of pancreas, are treated by PERT to replace these enzymes.

• In 20XX, TOBI Podhaler generated sales worth US$ 300 Million.

• Italy has followed Ireland and other EU countries such as Germany, Austria, Denmark and Luxembourg in approving Orkambi for patients with CF.

• It's estimated that 1 in every 2,500 babies born in the UK has cystic fibrosis.

• The revenues for Creon increased 22 percent in 2015, driven primarily by continued market growth.

• Zenpep sales surpassed US$ 200 Million mark in 2016.

• Some of the drugs that are under clinical studies are Tezacaftor (VX-661) + ivacaftor, VX-445 + tezacaftor + ivacaftor, VX-659 + tezacaftor + ivacaftor, PTI-428, AZD5634, QR-010 and POL6014 among many others.

iGATE RESEARCH report titled “Cystic Fibrosis Therapeutics Market (By Major Marketed Products, Pharmacological Class, & Geography) and Pipeline Analysis – Global Forecast to 2024” provides a comprehensive assessment of the Cystic Fibrosis Therapeutics Market.

This 121 Page report with 53 Figures and 6 Tables has been studied from 8 View Points:

1. Global Cystic Fibrosis Therapeutics Market & Forecast (2014 – 2024)

2. Global Cystic Fibrosis Therapeutics Market - Major Marketed Products Sales & Forecast (2012 - 2024)

3. Global Cystic Fibrosis Therapeutics Market - Pharmacological Class Sales & Forecast (2015 – 2021)

4. By Geography - Cystic Fibrosis Therapeutics Market (2014 – 2024)

5. Global Cystic Fibrosis Pipeline Product Analysis – By Company & Phase of Development

6. Cystic Fibrosis Company Profiles, Approved & Pipeline Product Analysis

7. Global Cystic Fibrosis Market - Industry Trends & Developments

8. Global Cystic Fibrosis Market - Growth Drivers & Challenges

Global Cystic Fibrosis Therapeutics Market - Major Marketed Products Covered

1. Orkambi (Lumacaftor/Ivacaftor)

2. Kalydeco (Ivacaftor)

3. Cayston (Inhaled Aztreonam)

4. Pulmozyme (Dornase Alfa)

5. TOBI/ TOBI Podhaler

6. Creon

7. Zenpep

8. Ventolin

9. Bronchitol (Inhaled Mannitol)

10. ADEKplusTM

11. Ibuprofen

Global Cystic Fibrosis Therapeutics Market - Pharmacological Class

• CFTR Modulators

• Mucolytic Agents

• Pancreatic Enzyme Replacement Products

• Antibiotics

• Other Therapies

Cystic Fibrosis Therapeutics Market – Geographical Analysis

1. United States

2. Canada

3. France

4. Germany

5. Italy

6. Spain

7. United Kingdom

8. Australia

9. Japan

10. China

11. India

12. South Korea

Cystic Fibrosis Company Profiles, Approved & Pipeline Product Analysis

1. Genentech, Inc. (A Member of the Roche Group)

2. Novartis

3. Gilead Sciences, Inc.

4. Vertex Pharmaceuticals Incorporated

5. AbbVie

6. GlaxoSmithKline

7. Johnson & Johnson

8. Allergan plc

9. Pharmaxis Ltd

10. Mylan N.V

Data Sources

iGATE RESEARCH employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. This report is built by using data and information sourced from Proprietary Information Database, Primary and Secondary Research Methodologies, and In house analysis by iGATE Research dedicated team of qualified professionals with deep industry experience and expertise.

Research Methodologies

Primary Research Methodologies: Questionnaires, Surveys, Interviews with Individuals, Small Groups, Telephonic Interview, etc.

Secondary Research Methodologies: Printable and Non-printable sources, Newspaper, Magazine and Journal Content, Government and NGO Statistics, white Papers, Information on the Web, Information from Agencies Such as Industry Bodies, Companies Annual Report, Government Agencies, Libraries and Local Councils and a large number of Paid Databases.

1. Executive Summary

2. Global Cystic Fibrosis Therapeutics Market & Forecast (2014 – 2024)

3. Global Cystic Fibrosis Therapeutics Market Share & Forecast

3.1 By Geography - Cystic Fibrosis Therapeutics Market Share & Forecast (2014 – 2024)

3.2 By Pharmacological Class - Cystic Fibrosis Therapeutics Market Share & Forecast (2015 – 2021)

4. Global Cystic Fibrosis Therapeutics Market - Major Marketed Products Sales & Forecast

4.1 Orkambi (Lumacaftor/Ivacaftor) Sales & Forecast (2015 – 2021)

4.2 Kalydeco (Ivacaftor) Sales & Forecast (2012 – 2021)

4.3 Cayston (Inhaled Aztreonam) Sales & Forecast (2010 – 2021)

4.4 Pulmozyme (Dornase Alfa) Sales & Forecast (2012 – 2021)

4.5 TOBI/ TOBI Podhaler Sales (2012 – 2016)

4.6 Creon Sales & Forecast (2011 – 2021)

4.7 Zenpep Sales & Forecast (2014 – 2021)

4.8 Ventolin Sales & Forecast (2012 – 2021)

4.9 Bronchitol (Inhaled Mannitol) Sales & Forecast (2013 – 2021)

4.10 ADEKplusTM

4.11 Ibuprofen

5. Global Cystic Fibrosis Therapeutics Market - Pharmacological Class Sales & Forecast (2015 – 2021)

5.1 CFTR Modulators Sales & Forecast

5.2 Mucolytic Agents Sales & Forecast

5.3 Pancreatic Enzyme Replacement Products Sales & Forecast

5.4 Antibiotics Sales & Forecast

5.5 Other Therapies Sales & Forecast

6. By Geography - Cystic Fibrosis Therapeutics Market (2014 – 2024)

6.1 United States Cystic Fibrosis Therapeutics Market & Forecast

6.2 Canada Cystic Fibrosis Therapeutics Market & Forecast

6.3 France Cystic Fibrosis Therapeutics Market & Forecast

6.4 Germany Cystic Fibrosis Therapeutics Market & Forecast

6.5 Italy Cystic Fibrosis Therapeutics Market & Forecast

6.6 Spain Cystic Fibrosis Therapeutics Market & Forecast

6.7 United Kingdom Cystic Fibrosis Therapeutics Market & Forecast

6.8 Australia Cystic Fibrosis Therapeutics Market & Forecast

6.9 Japan Cystic Fibrosis Therapeutics Market & Forecast

6.10 China Cystic Fibrosis Therapeutics Market & Forecast

6.11 India Cystic Fibrosis Therapeutics Market & Forecast

6.12 South Korea Cystic Fibrosis Therapeutics Market & Forecast

7. Global Cystic Fibrosis Pipeline Product Analysis – By Company & Phase of Development

8. Cystic Fibrosis Company Profiles, Approved & Pipeline Product Analysis

8.1 Genentech, Inc. (A Member of the Roche Group)

8.2 Novartis

8.3 Gilead Sciences, Inc.

8.4 Vertex Pharmaceuticals Incorporated

8.5 AbbVie

8.6 GlaxoSmithKline

8.7 Johnson & Johnson

8.8 Allergan plc

8.9 Pharmaxis Ltd

8.10 Mylan N.V.

9. Global Cystic Fibrosis Market - Industry Trends & Developments

9.1 Genetic Testing

9.2 Technological Advances

9.3 CFTR Modulators - Gaining Momentum

9.4 Upsurge in the Number of Strategic Collaborations

9.5 Combination Therapy

9.6 Co-pay and Assistance Programs by Vendors

9.7 Increased R&D Activities: Drives Market Growth

10. Global Cystic Fibrosis Market – Growth Drivers

10.1 Robust Pipeline

10.2 Increasing Prevalence of Cystic Fibrosis

10.3 Improvement in Diagnostic Technologies

10.4 Unmet Medical Needs

11. Global Cystic Fibrosis Market – Challenges

List of Figures:

Figure 2-1: Global - Cystic Fibrosis Therapeutics Market (Million US$), 2014 - 2016

Figure 2-2: Global – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 4-1: Global - Orkambi (Lumacaftor/Ivacaftor) Sales (Million US$), 2015 – 2016

Figure 4-2: Global – Forecast for Orkambi (Lumacaftor/Ivacaftor) Sales (Million US$), 2017 – 2021

Figure 4-3: Global - Kalydeco (Ivacaftor) Sales (Million US$), 2012 – 2016

Figure 4-4: Global – Forecast for Kalydeco (Ivacaftor) Sales (Million US$), 2017 – 2021

Figure 4-5: Global - Cayston (Inhaled Aztreonam) Sales (Million US$), 2010 – 2016

Figure 4-6: Global – Forecast for Cayston (Inhaled Aztreonam) Sales (Million US$), 2017 – 2021

Figure 4-7: Global - Pulmozyme (Dornase Alfa) Sales (Million US$), 2012 – 2016

Figure 4-8: Global – Forecast for Pulmozyme (Dornase Alfa) Sales (Million US$), 2017 – 2021

Figure 4-9: Global - TOBI/ TOBI Podhaler Sales (Million US$), 2012 – 2016

Figure 4-10: Global - Creon Sales (Million US$), 2011 – 2016

Figure 4-11: Global – Forecast for Creon Sales (Million US$), 2017 – 2021

Figure 4-12: Global - Zenpep Sales (Million US$), 2014 – 2016

Figure 4-13: Global – Forecast for Zenpep Sales (Million US$), 2017 – 2021

Figure 4-14: Global - Ventolin Sales (Million US$), 2012 – 2016

Figure 4-15: Global – Forecast for Ventolin Sales (Million US$), 2017 – 2021

Figure 4-16: Global - Bronchitol (Inhaled Mannitol) Sales (Million US$), 2013 – 2016

Figure 4-17: Global – Forecast for Bronchitol (Inhaled Mannitol) Sales (Million US$), 2017 – 2021

Figure 5-1: Global Cystic Fibrosis Therapeutics - CFTR Modulators Sales (Million US$), 2015 – 2016

Figure 5-2: Global Cystic Fibrosis Therapeutics – Forecast for CFTR Modulators Sales (Million US$), 2017 – 2021

Figure 5-3: Global Cystic Fibrosis Therapeutics - Mucolytic Agents Sales (Million US$), 2015 – 2016

Figure 5-4: Global Cystic Fibrosis Therapeutics – Forecast for Mucolytic Agents Sales (Million US$), 2017 – 2021

Figure 5-5: Global Cystic Fibrosis Therapeutics - Pancreatic Enzyme Replacement Products Sales (Million US$), 2015 – 2016

Figure 5-6: Global Cystic Fibrosis Therapeutics – Forecast for Pancreatic Enzyme Replacement Products Sales (Million US$), 2017 – 2021

Figure 5-7: Global Cystic Fibrosis Therapeutics - Antibiotics Sales (Million US$), 2015 – 2016

Figure 5-8: Global Cystic Fibrosis Therapeutics – Forecast for Antibiotics Sales (Million US$), 2017 – 2021

Figure 5-9: Global Cystic Fibrosis Therapeutics - Other Therapies Sales (Million US$), 2015 – 2016

Figure 5-10: Global Cystic Fibrosis Therapeutics – Forecast for Other Therapies Sales (Million US$), 2017 – 2021

Figure 6-1: United States - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-2: United States – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-3: Canada - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-4: Canada – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-5: France - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-6: France – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-7: Germany - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-8: Germany – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-9: Italy - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-10: Italy – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-11: Spain - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-12: Spain – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-13: United Kingdom - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-14: United Kingdom – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-15: Australia - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-16: Australia – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-17: Japan - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-18: Japan – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-19: China - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-20: China – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-21: India - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-22: India – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

Figure 6-23: South Korea - Cystic Fibrosis Therapeutics Market (Million US$), 2014 – 2016

Figure 6-24: South Korea – Forecast for Cystic Fibrosis Therapeutics Market (Million US$), 2017 - 2024

List of Tables:

Table 3-1: By Geography - Cystic Fibrosis Therapeutics Market Share (Percent), 2014 - 2016

Table 3-2: By Geography – Forecast for Cystic Fibrosis Therapeutics Market Share (Percent), 2017 - 2024

Table 3-3: By Pharmacological Class - Cystic Fibrosis Therapeutics Market Share (Percent), 2015 - 2016

Table 3-4: By Pharmacological Class – Forecast for Cystic Fibrosis Therapeutics Market Share (Percent), 2017 - 2021

Table 7-1: Global - Cystic Fibrosis Pipeline Product (Pre-Clinical, Phase 1, Phase 2, Phase 3), 2017

Table 10-1: Cystic Fibrosis – List of Pipeline Drugs (as of September 2017)